Self Employed Tax Deductions Worksheet 2016

Finally keep in mind that half of this amount or 565182 is deductible. If youre not sure where something goes dont worry every expense on here except for meals is deducted at the same rate.

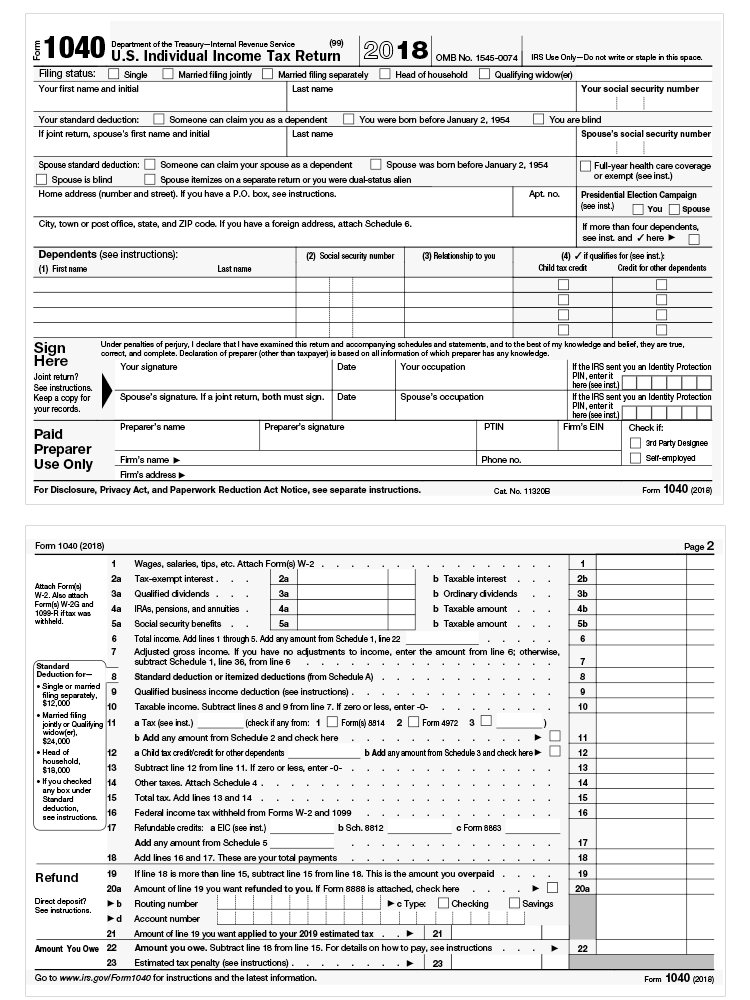

2019 Form 1040 Se 2021 Tax Forms 1040 Printable

Keep in mind you can only deduct 50 of this category.

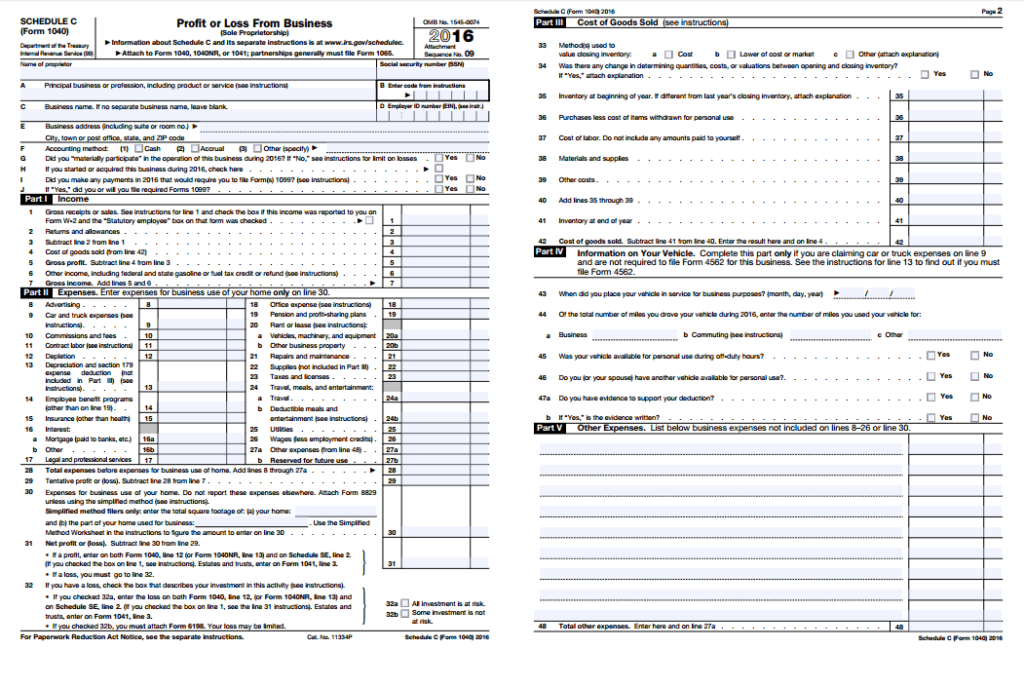

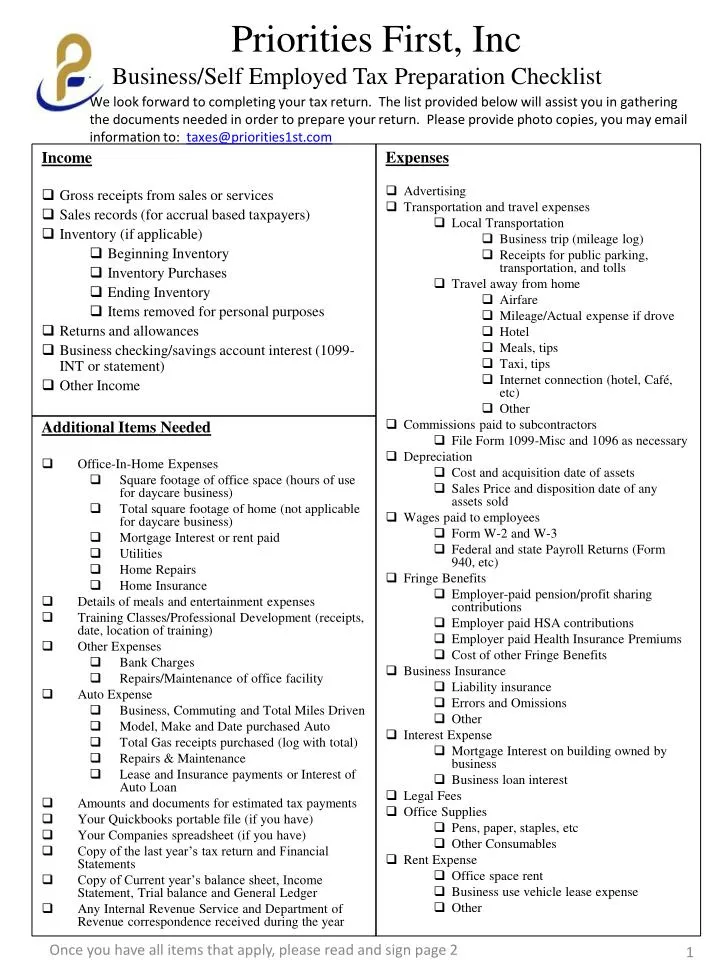

Self employed tax deductions worksheet 2016. Try your best to fill this out. They provide information on things such as business expenses personal expenses mortgage interest and other kinds of deductions that can be claimed. What is a self-employed tax deductions worksheet.

Applying the 153 tax rate to this amount shows a self-employment tax of 1130364. That means that you can no longer write off taking your client out to events like the ballet or a baseball game. If you made the deduction on Schedule C or made and deducted more than your allowed plan contribution for yourself you must amend your Form 1040 tax return and Schedule C.

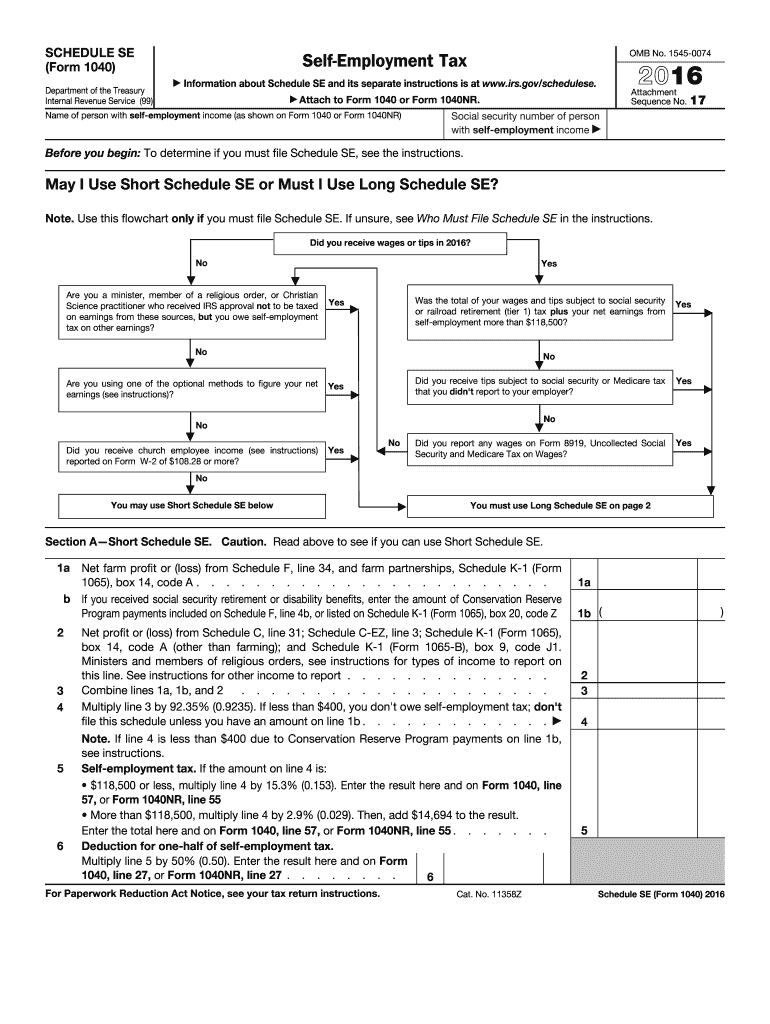

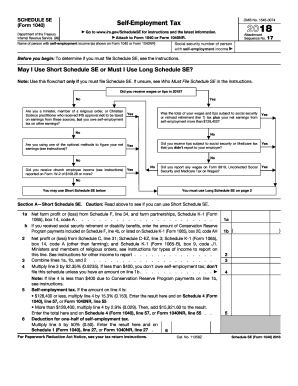

Before you can determine if you are subject to self-employment tax and income tax. Self Employed Tax Deductions Worksheet together with Fresh 2016 Self Employment Tax and Deduction Worksheet Sabaax. In general anytime the wording self-employment tax is used it only refers to Social Security and Medicare taxes and not any other tax like income tax.

Also know that the 2018 tax bill eliminated client entertainment as a tax deduction. CPF relief cap of 37740. You will compute this amount as part of Schedule SE.

One of these decisions is whether or not to incorporate. The purpose of this worksheet is to help you organize your tax deductible business expenses. Actual amount contributed by you.

If youre self-employed youre responsible for paying your own share of those Social Security and Medicare contributions collectively known as SECA. 15 of the cost each year. 37 of your net trade income assessed.

Do not include expenses for which you have been reimbursed expect to be reimbursed or are reimbursable. It is a set of worksheets that are designed to help people who are self-employed prepare their tax returns. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

Tax Worksheet for Self-employed Independent contractors Sole proprietors Single LLC LLCs 1099-MISC with box 7 income listed. Legal accounting and other professional fees Legal fees paid when purchasing a business property are not deductible - instead you must include them in the cost to purchase the property. Financing fees are deductible but they must be deducted over 5 years ie.

In order for an expense to be deductible it must be considered an ordinary and necessary expense. 2016 Self Employment Tax and Deduction Worksheet together with Statistics and Probability Archive December 06 2016 Cheggc. You may include other applicable expenses.

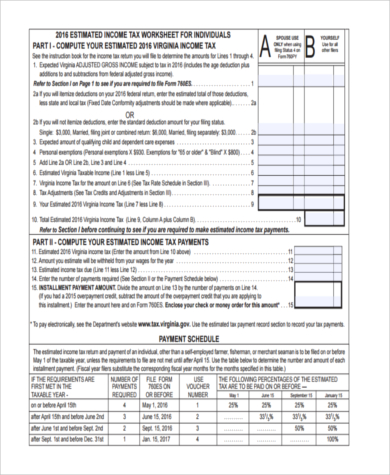

Every business owner is going to make a number of decisions that can help their business grow. For YA 2020 your tax relief for your Medisave and voluntary CPF contributions will be capped at the lower of. As a self-employed individual if you made contributions to a retirement plan such as a SEP SIMPLE or Keogh plan you may be able to claim a deduction on your tax return for those contributions.

You too can be taxed just like your traditionally employed peers by claiming an SECA deduction on Line 27 of Form 1040. The TaxAct program offers the Publication 560 Worksheet in order for certain self-employed individuals to calculate their maximum deductible contribution limit. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.

That means if you go out for a 500 meal the deductible portion is only 250. You are a self-employed person who has made compulsory Medisave contributions and voluntary CPF contributions in the year 2019. Plan contributions for a self-employed individual are deducted on Form 1040 Schedule 1 on the line for self-employed SEP SIMPLE and qualified plans and not on the Schedule C.

A Self Employed Tax Worksheet can be a big help if you are having trouble figuring out how to take the tax deductions you need for your business. Because if you are self-employed and paying say 4000 per year more in Medicare and social security taxes than an employee pays and you are in a 25 tax bracket the self-employment deduction means you are still paying 3000 more in Medicare and social security taxes than an employee who is making the same amount of money a 4000 deduction would only result in a 1000 tax savings.

Form 1040 Self Employment Schedule C 2021 Tax Forms 1040 Printable

Newbest Of Self Employed Tax Deductions Worksheet Check More At Https Www Chemistry Worksheets Self Employed Tax Deductions Reading Comprehension Worksheets

Business Tax Deductions Worksheet Small Business Tax Deductions Small Business Tax Business Tax Deductions

Form 1040 Gets An Overhaul Under Tax Reform Putnam Wealth Management

Self Employment Expenses Worksheet Worksheet List

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Free 7 Sample Self Employed Tax Forms In Ms Word Pdf

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

Hair Stylist Tax Deduction Worksheet Fill Out And Sign Printable Pdf Template Signnow

Self Employment Tax Form Fill Out And Sign Printable Pdf Template Signnow

Ppt Priorities First Inc Business Self Employed Tax Preparation Checklist Powerpoint Presentation Id 1675536

Self Employment Expenses Worksheet Nidecmege

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

Self Employment Expenses Worksheet Promotiontablecovers

Best Of 2017 Self Employment Tax Form Models Form Ideas

Self Employed Business Tax Deduction Sheet A Success Of Your Business The Best Insuran Small Business Tax Deductions Small Business Tax Business Tax Deductions

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

The Epic Cheat Sheet To Deductions For Self Employed Rockstars